ERCI Advanced Diploma in Business Administration (Banking and Finance) (TEACH-OUT BY SEP 2020)

Introduction

The Advanced Diploma in Business Administration (Banking and Finance) is designed to develop and groom students in strategic thinking and analytical abilities, which are essential qualities of contemporary investments, finance managers and executives. Students will acquire cutting-edge financial and investment knowledge important for keeping up with change in the business environment. Students will gain knowledge in formulating investment strategies through practical modules, modern and relevant assessment methods including examinations, individual assignments, group assignments and group presentations.

ERCI runs its classes on a lecture-tutorial system. The average teacher-student ratio for lectures and tutorials are as follows:

- Lectures – 150 Students to 1 Lecturer

- Tutorials – 35 Students to 1 Tutor

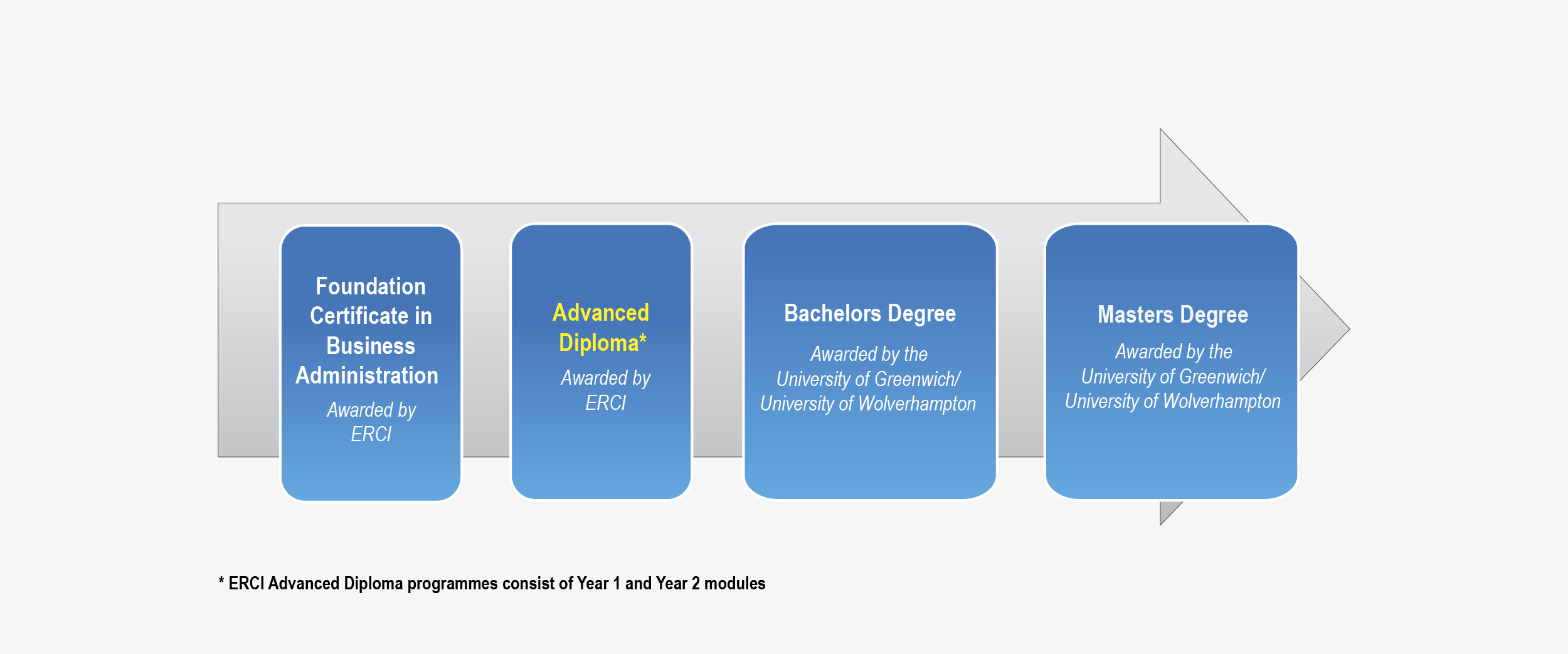

Upon completion of the Advanced Diploma in Business Administration (Banking and Finance), students will be eligible for entry into the final year of the Bachelor of Arts (Honours) Business Management (Top Up) (Various specialisations available) programme offered by the University of Greenwich or the Bachelor of Arts (Honours) in International Business Management (Top Up) programme offered by the University of Wolverhampton.

Course Delivery

Students undertaking the Advanced Diploma in Business Administration (Banking and Finance) programme will be expected to complete 15 modules of academic study over 8 semesters. This programme is available in full and part time modes, and will take 20 months to complete. Full-time students will attend classes 5 days a week on weekdays, while part-time students will attend classes 3 times a week on weekdays and/or on weekends.

Course Structure

Module Descriptions

Specialisation Modules

ERCBA 208 – International Financial Management

This course provides a comparative analysis of the international financial and banking environment. Course material examines the structure and operations of international financial markets through an analysis of the economic principles underlying the evolution of market practice and instruments. The internationalization of capital flows has enhanced global liquidity and the price sensitivity of markets, so leading to new hedging and investment opportunities. By examining the activities of institutions when trading positions to hedge or invest, the syllabus develops an understanding of the risk/reward relationship that drives the growth of these markets. A distinctive feature of this course/module is the inclusion of alternative banking systems especially Islamic banking, which has a strong base in Muslim countries or countries with a sizeable Muslim population. A critical approach will be used to compare the role of alternative financial markets and their banking systems with established financial systems.

ERCBA 213 – Investment and Fund Management

This course aims to bridge the gap between academic theory and real world practice where students are expected to understand the basic concepts with their assumptions and accurately apply the concepts, methodology in practice. Therefore the core module of this course focuses more on how to apply the theory/concept and demonstrate it in assignments by analyzing real data taken from various public domains. To complete the course well, students need to be hands on in applying the knowledge (concept, formula and methodology) in both final examination and assignments.

ERCBA 214 – Managerial Finance

Managerial finance looks at theory and evidence concerning major corporate financial decisions and its practical implication. It is intended to give the students a framework of understanding the determinants of corporate financing, capital budgeting evaluation and additional topic in corporate merger and acquisition. Students will also learn some basic asset valuation techniques employed and there will also be focus on concepts and their application in real world.

ERCBA 215 – Banking & Financial Institutions

This course is designed to provide students with basic concepts of time value of money, risk, financial system & instruments, bank & central bank as financial institution. Valuation of financial instruments such as bond, stocks, derivatives are other core discussion in this course providing students an understanding of both the concept and computation skills. In addition, the focus of the course will be highlighted on the fundamental of bank management, structure of the bank, regulating the financial system, as well as the roles of central bank. As bank is not the only financial firms today, the course will also promote understanding about other financial institutions as non-depository institutions.

Core Modules

ERCBA 101 – Business Communication

This module focuses on the key business communication skills necessary for effective and efficient operations in today’s complex business environment. Students will be introduced to basic communication concepts and principles, and will develop an understanding of the importance of both verbal and non-verbal communication skills. Students will have opportunities to apply their newly acquired communication skills in small and larger group settings and in creating effective documents appropriate to different business contexts.

ERCBA 102 – Principles of Management

This module explores the processes and functions of management. Students will be given the opportunity to explore traditional and modern management theories and the Planning, Organisation, Leadership and Control (POLC) approach to management. The module will promote an understanding of management from a holistic perspective and will examine local, international and global management practices.

ERCBA 104 – Human Resource Management

In tod In today’s complex economic & social environments, it is important to manage human resources well in order to build an enriching work environment and an effective and organization. This course provides the basic concepts of human resource management that are useful all employees and managers.

ERCBA 105 – Principles of Accounting

This course aims to provide students with a solid foundation in the dynamic and growing field of accounting. Students will be introduced to the double-entry bookkeeping and the process of completing the Accounting cycle. Cash, Receivables, Inventory system, and Fixed Assets will be discussed in details in this course.

ERCBA 106 – Principles of Finance

This is an introductory course of corporate finance. Students who aim to have some knowledge in financial management will learn some basic concepts of investment decisions and financing decisions. Acquiring the right decisions today will determine the success of the business in the future. The students will also be introduced to some market players and various types of financial instruments. Furthermore, how to estimate the intrinsic value of the financial instruments will be another challenging part of the course.

ERCBA 108 – Principles of Marketing

This module will introduce students to key basic concepts in marketing and will focus on critical competitive strategies for generating and meeting customer satisfaction. Additionally, the module will focus on the activities used to implement marketing strategies created to meet customer needs and expectations.

ERCBA 110 – Supply Chain Management

This module aims to equip the students with key skills and knowledge required to perform effectively in a supply chain management environment. To meet the growing importance of supply chain, the module also aims to equip the students with in-depth understanding and broad-based knowledge on logistics and supply chain management.

ERCBA 207 – Customer Relationship Management

This module enables students to understand and acquire basic customer service skills that are necessary for the promotion of customer satisfaction. The course promotes competency in terms of information exchange, active listening, relationship building, complaint handling, meeting customer expectations and promoting loyalty through ongoing classroom activities and discussions. This course covers customer relationship management (CRM) and customer driven, market–based management practices that assist an organisation in attracting customers whilst sustaining profitability. Students will learn the skills to utilise CRM more accurately in evaluating the market place; evaluate competitors and determining the lifetime value of the customer.

ERCBA 210 – Principles of Economics

This course provides students with a general knowledge of the basic microeconomics principles and macroeconomics policies and to relate these to the major economic institutions that forms the backbone of a country’s enterprise system. It helps students gain a better understanding and the ability to analyze important microeconomics and macroeconomics matters that affect their daily lives. Principles of Economics will serve as an important step toward a student’s plan for advance study in Economics.

ERCBA 211 – Business Ethics & Social Responsibility

This module is designed to provide students with an appreciation and understanding of business ethics and corporate social responsibility. From the time the Enron Corporation collapsed in 2001, business ethics, corporate governance and corporate social responsibility has seldom strayed from the front pages of the press. The aim of this subject is to ensure students incorporate an ethical framework when making responsible business decisions. Students who master the knowledge and skill of integrating business ethics into their decision making will find this subject very useful for future growth of their respective organisations.

ERCFP 001 – Industry Project

This module aims to develop a project concept, partnership and plan. Students will work with a designated lecturer to supervise them during the process of doing this project. The project undertaken is with an industry partner. Project students are expected to utilize their learning throughout the course of core units and specialization. By the end of this module, students will be able to identify issues, propose solutions, utilize skills developed during the whole program and inter-disciplinary teamwork. The students will learn to present and advocate, in written and oral formats, a project concept and plan for development and production. In addition, they will learn how to evaluate challenges affecting practical implementation of their learning.

Course Availability

Intakes for the Advanced Diploma in Business Administration (Banking and Finance) programmes are available 5 times a year. All applications should be submitted to ERCI no later than 1 month before the commencement date.

Assessment Framework

Courses are assessed by a combination of coursework, practical assignments and examinations. Unless otherwise stated, all modules within the Advanced Diploma in Business Administration (Marketing and Sales Management) programme are assessed based on the 3-3-4 framework: 30% on examination, 30% on individual assignment(s) and/or class tests, 40% on group assignment(s) and/or class participation.

Entry Requirements

All applications are subject to the Institute’s assessment of eligibility for entry into the programme.

Graduation Requirements

Students must pass all prescribed modules in the Advanced Diploma programme with a minimum grade of P (Pass).

Course Fees

For a full listing of course fees and other charges, please select one of the following:

– Fees Payable for Local Applicants

– Fees Payable for International Applicants

Programme Enquiry

By submitting your personal information above, you have given your consent for a ERC Institute representative to contact you on offers, promotions and information for ERC Institute programmes.